We know most organizations only close their books or run statements once a year. The details of these year-end tasks may get a little fuzzy, but don’t let it cause you any anxiety. Here are a few tips you should remember for your year-end, plus a heads-up about a useful resource to help you nail down all the details and processes you’ll need.

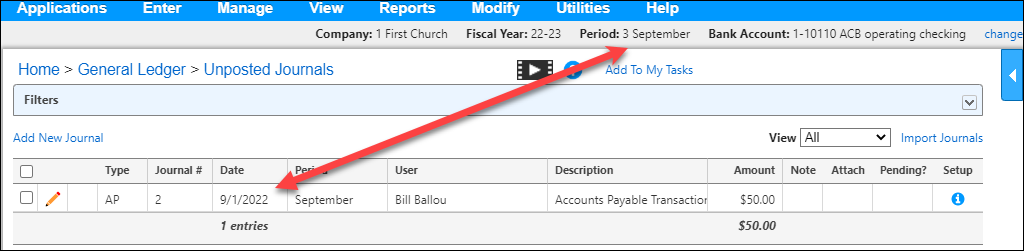

1. For your General Ledger, make sure you complete all sub-ledger postings to the General Ledger before trying to run Year-End reports.

- Because General Ledger is the foundation for all transaction activity, any Accounts Payable, Payroll, or Giving postings need to be finalized (posted to the General Ledger) before running Statement of Financial Position or the Statement of Activities.

- Be sure your dates match your period or your subledger totals will not match your General Ledger totals for that period.

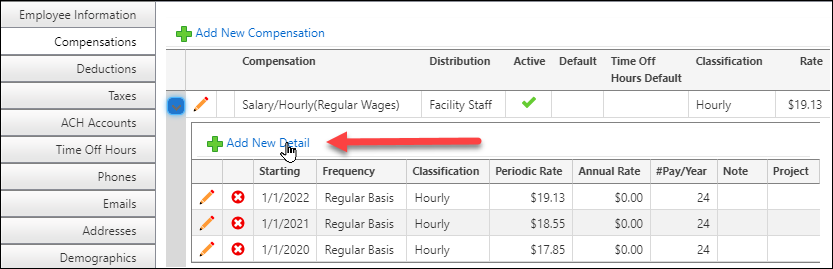

2. In Payroll, to change your salaries for your employees for the new year by opening the section under Compensation and choosing to Add New Detail. This will allow you to keep the current year settings and show the new payment for the new year in the new distribution. Be sure to set the starting date for when the new compensation rate begins. It is wise to set the starting date to land at the beginning of a pay period as the payment will NOT prorate for a partial payment period.

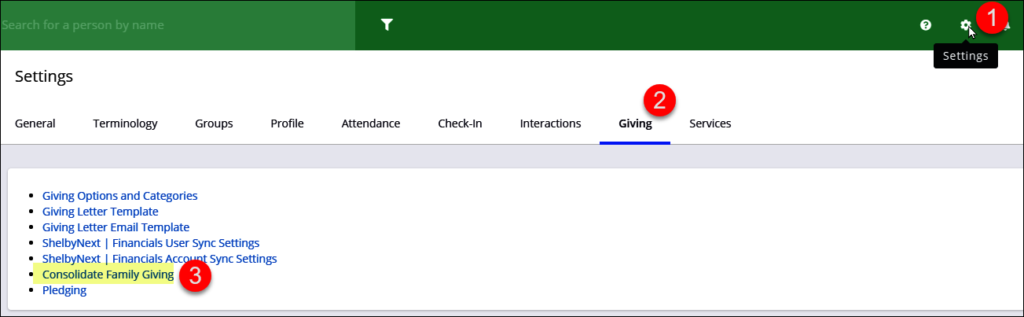

- Giving, Consolidate Family Giving (assumes the family member is marked Group Giving with Family)

- When a family member gives a gift that needs to be combined for the Giving Statement for both spouses (as an example), then the gift from the family member who is NOT the primary in the family needs to be consolidated into the primary’s record using the Consolidate Family Giving option under Settings | Giving | Consolidate Family Giving.

- This is also true when the Primary member of the family dies, and you need to make the spouse or someone else in the family the Primary. First, you change the Primary to a different family position, for example “husband”. Next, you change the family position for the spouse (for example) to Primary. Then, you follow the steps above for all the giving to transfer to the living spouse. You can then remove the deceased spouse when needed while keeping the giving record connected to the family.

- Want even more Year-End Tips and Tricks? Then mark your calendars and register for one of our Year-End Procedures Virtual Workshops that will be offered in December and January.

In this two-hour, interactive Year-End Workshop we will cover the most important tasks and processes needed for a successful end of the year; from running Giving Statements to closing the fiscal year to running Payroll and Accounts Payable reports for workers and the IRS. This course will also offer best practices, a Year-End checklist to help you keep your tasks in order, and a detailed workbook of the material covered.

This workshop will be offered several times to allow more individuals to attend to match their schedule needs Click below to find the session time that works best for you. Space is limited, so reserve your spot now. For $50 per person, you will receive a detailed workbook, 2 hours of quality instruction with time for questions and discussion, and a Year-End Checklist. You can SIGN UP HERE!